Vanadium Market Fundamentals

Historically, vanadium supply and demand have relied upon steel supply and demand.

The limited capacity of vanadium-producing steel plants has driven vanadium’s price volatility. With growth in primary production of vanadium, the dependency of vanadium supply on co-production from steel is decreasing.

The same trend would be likely to follow in vanadium demand, if new uses of vanadium continue to grow faster than steel demand, such as from energy storage.

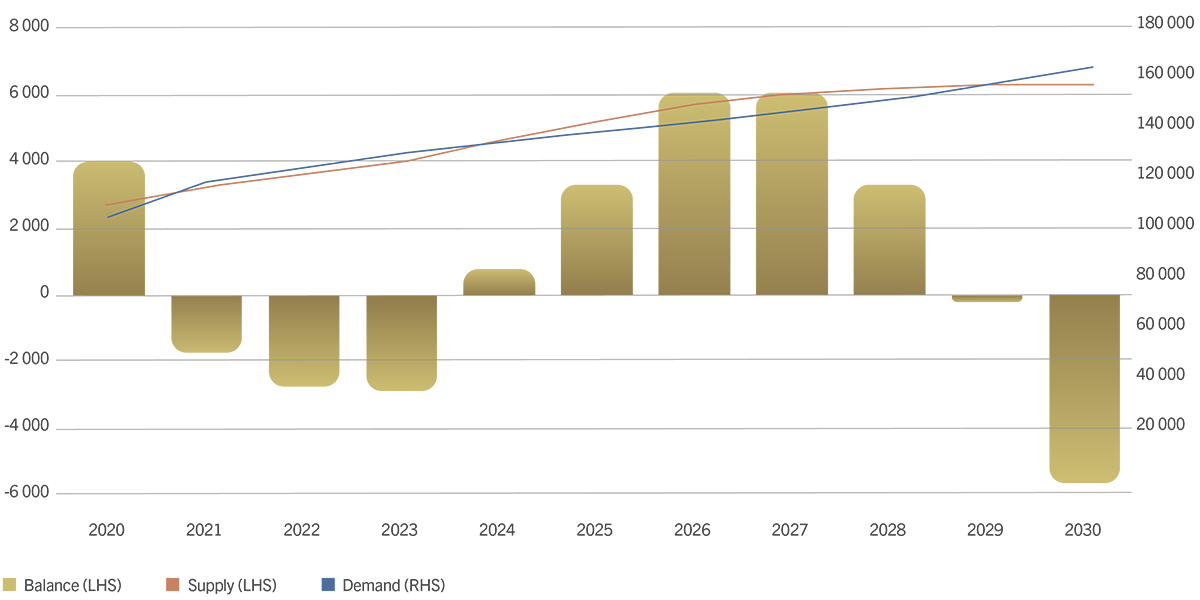

Supply and demand dynamics point to a structural net deficit.

Supply is concentrated and constrained as:

- In China, capacity utilisation from slag producers was estimated at 80% - 90% in 2020, with the top five producers operating close to full capacity. In 2020, Russia was also operating close to full capacity, at approximately 90%.

- The steel industry in China has been increasingly reliant on imported iron ore, which is non-vanadium bearing.

- Over the longer term, Chinese vanadium production will be constrained by the decline in domestic iron ore supply and iron ore quality, coupled with environmental restrictions on steelmakers, co-product and stone coal vanadium producers as well as the ban on vanadium slag imports.

Growing Demand

Vanadium For Steel

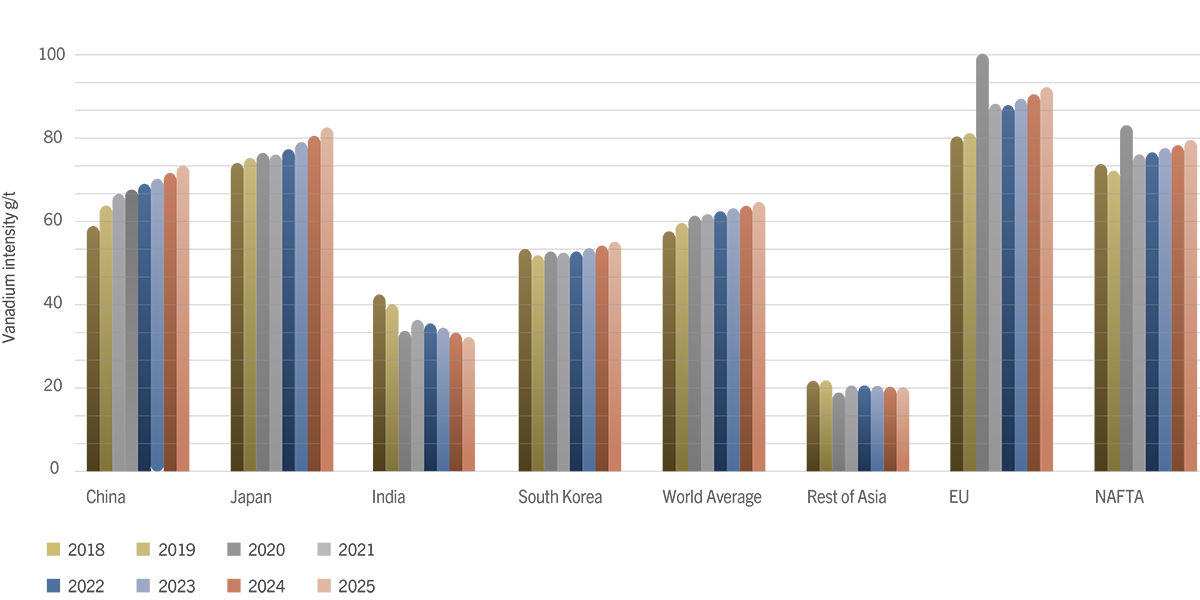

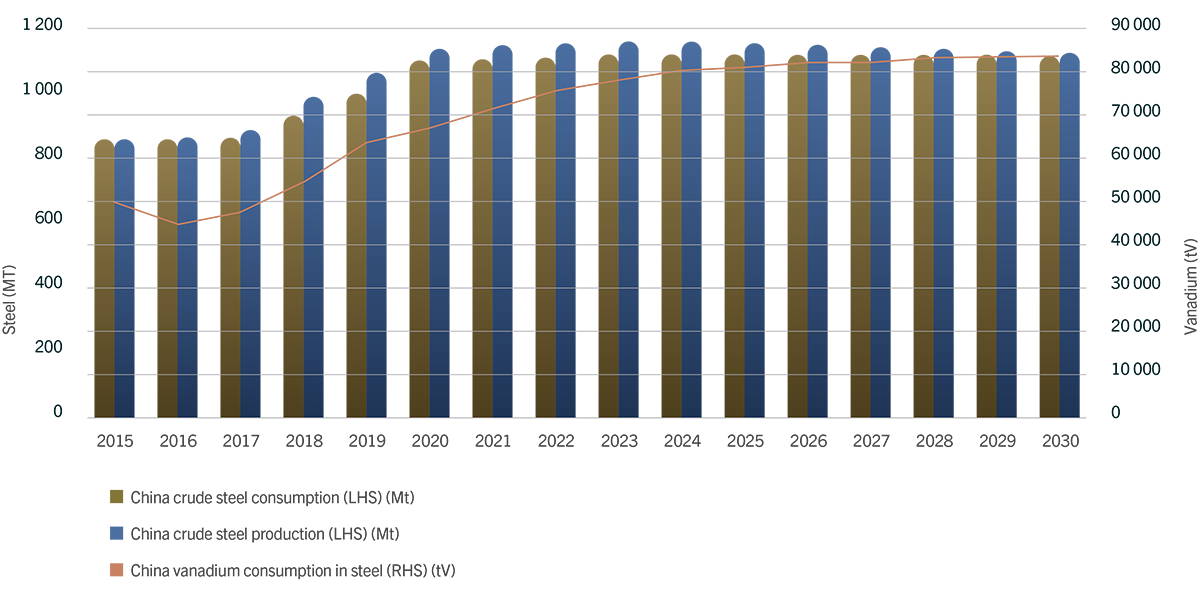

The growing demand for vanadium is underpinned by the higher intensity of use of vanadium in steel.

Developed economies such as Europe, Japan, and North America have higher vanadium intensity than developing countries.

China surpasses the world average in its intensity of use, supported by enhanced compliance with rebar standards.

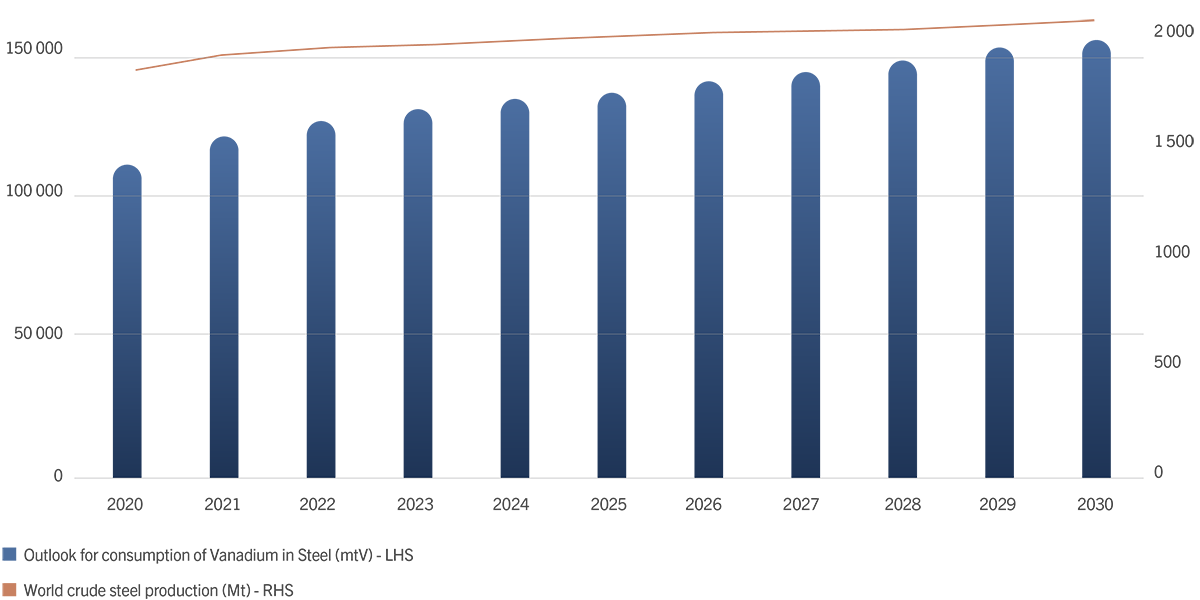

According to Roskill, vanadium demand in the steel market will grow at a CAGR of about 2,7% through to 2030, with global vanadium demand from steel reaching approximately 136 000 tonnes by 2030.

The vanadium market moved into a short-term surplus in 2020 as ex-China steel mill shutdowns continued due to the COVID-19 pandemic. Roskill forecasted that the market will move into a deficit from 2021 to 2023, followed by a surplus from 2024, and that the market will revert to a deficit from 2029. Roskill takes the assumption that all new projects announced will come into production.

Vanadium for Energy Storage

While vanadium demand will be underwritten by the growing intensity of use of vanadium in the steel market, the energy storage industry offers significant demand upside.

The growth in demand for vanadium will be impacted by the demand for VRFBs and by how quickly non-Chinese global steel and alloy demand recovers.

According to Roskill, vanadium demand from VRFBs will grow at a CAGR of approximately 56,7% through to 2030 – the longer-term demand will be even greater.

For example, the World Bank Group predicts that by 2050 the vanadium demand from energy storage alone could be twice as large as global vanadium production in 2018.