Vanadium for Energy Storage

Bushveld Energy participates in the global value chain for energy storage through the supply of vanadium mined by the group, electrolytes that will be produced by the group, and investments in battery companies and manufacturing.

The energy sector is undergoing a fundamental transition – both in the extent of electrification and the advent of renewable energy.

Electricity’s share of global energy consumption has doubled from 10% in 1980 to 20% today. It is expected to exceed 40% by 2050.

At the same time, renewable energy is displacing fossil fuels in energy generation. These two changes have enormous implications for global energy production and all minerals involved in the electricity value chain.

Electricity is much more difficult to store than other sources of energy. In addition, the variability of renewable energy sources further exacerbates the daily misalignment between when electricity is produced and consumed.

Both trends increase the need for stationary storage, including large batteries. Energy storage, especially long-duration storage (four or more hours per day), is essential to support the growth in electricity demand while enabling the energy transition to a carbon-neutral world.

Energy Growth Demands

Stationary energy storage is essential to support growth in electricity demand while the world transitions to carbon neutrality. It is now one of the most dynamic and rapidly advancing sectors in the broader technology industry.

According to Bloomberg New Energy Finance, global stationary energy storage installations will grow 122-fold from 2018 to 2040, rising from 17 GWh to 2 850 GWh by 2040. In the shorter term, according to Guidehouse Insights, formerly Navigant Research, the market will reach US$50 billion in annual value by 2027.

Unsurprisingly, investments in battery technologies are also accelerating, with Mercom Capital reporting that in 2021 corporate funding of battery storage companies reached US$17 billion compared to US$6,5 billion in 2020, and US$2,8 billion in 2019, almost tripling each of the past two years.

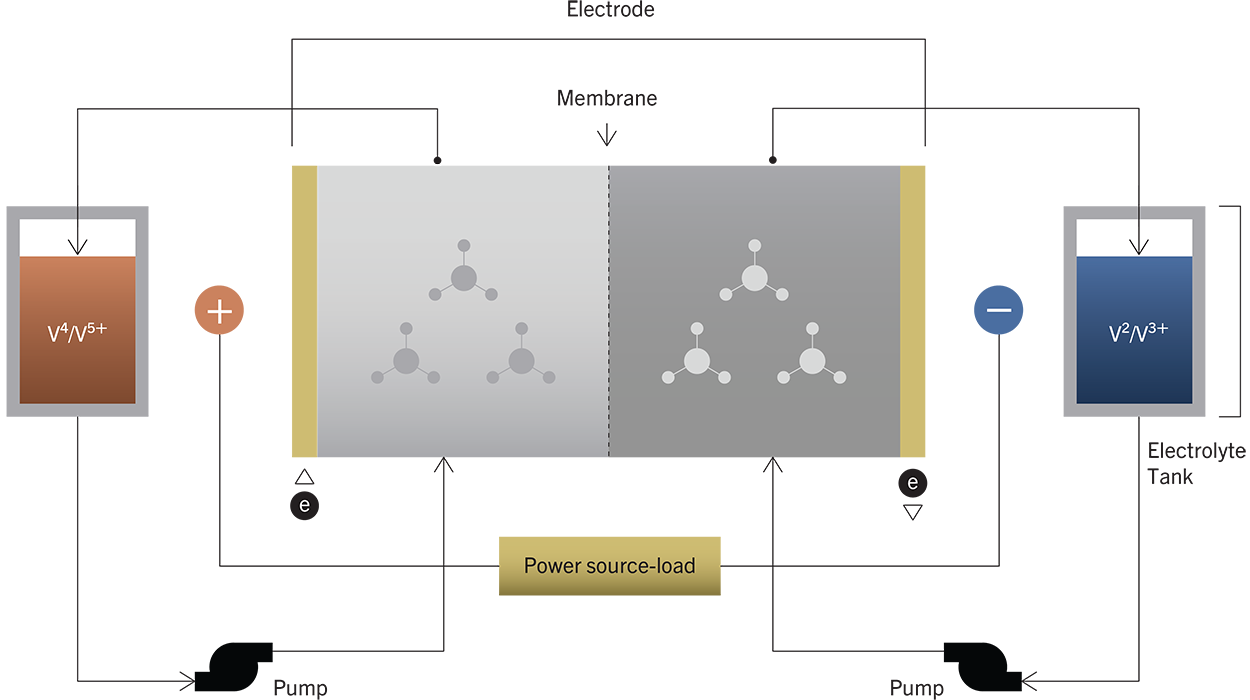

Vanadium Redox Flow Batteries (VRFBs) are the simplest and most developed flow batteries in commercial operation, and are well-positioned to take a significant share of the stationary energy storage market.

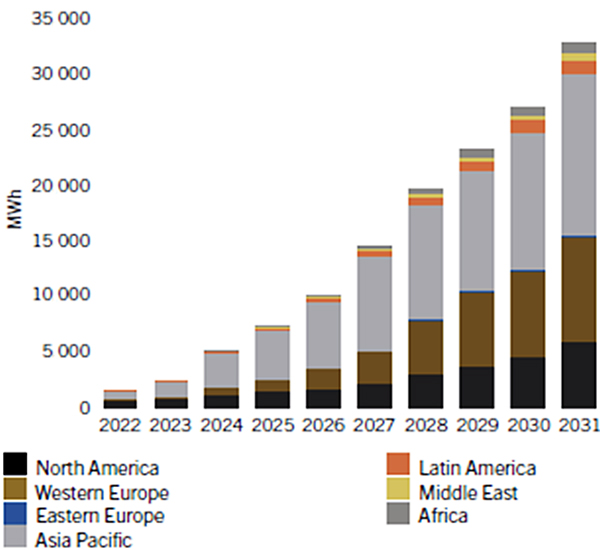

Annual Installed Utility and Commercial & Industrial VRFB Deployment Energy Capacity by Region (All Application Segments), World Markets: 2022-2031

Source: Guidehouse Insights, 2022

Vanadium Redox Flow Batteries

VRFBs have a long lifespan, low operating costs, are safe and have a low environmental impact in manufacturing. The vanadium used in the batteries can be reused or recycled easily.

Commercialisation of VRFBs is accelerating despite misconceptions and comparisons based on upfront (rather than lifetime) costs, especially compared to the entrenched position of lithium-ion batteries.

Increasing understanding of the technology, reaching economies of scale in supply chain, and developing innovative funding solutions are starting to overcome these barriers.

The ability to recycle the vanadium or reuse the entire electrolyte in a VRFB creates an opportunity for solutions such as electrolyte rental. These solutions will accelerate adoption of VRFBs at utility scale by reducing the upfront capital costs, while creating new economic opportunities for vanadium producers.

Long Lifespan Cycles

Ability to repeatedly charge and discharge more than 35 000 times for a lifespan of over 20 years

100% Depth of Discharge

Discharge without material performance degradation is unique to VRFBs

Low Cost

Low cost per kWh when fully used at least once daily (cheaper than Li-ion batteries)

SPEED

Very fast response time of less than 70 ms

Scalability

Scalable capacity to store large quantities of energy

Flexibility

Flexibility that allows for capturing the multi-stacked values of energy storage in grid applications

Sustainability

30% lower carbon footprint than li-ion batteries – 100% of vanadium is re-usable on decommissioning of a system

No Cross-Contamination

No cross-contamination since there is only one battery element – unique among flow batteries

Safety

No fire or smoke risk from thermal runaway

VRFB Outlook

Global deployment of VRFBs is starting to accelerate, due to increasing demand for long-duration energy storage. According to Guidehouse Insights, the market already exceeds 1 GWh per annum, with Asia Pacific leading. By 2031, it is estimated that Asia Pacific will reach around 14,5 GWh of annual VRFB energy capacity, out of a global demand of 32 GWh.

China is leading the way in VRFBs, and currently accounts for 95% of the global market. Its growth is a direct result of policies aimed at diversifying the technologies used to store energy. Chinese policies explicitly favour deployment of VRFBs and establishment of supply chains, such as VRFB assembly and vanadium electrolyte production, leading to innovation, manufacturing scale and cost decreases. China already has nearly a dozen local VRFB companies. Over 3 700 MWh of VRFB projects have been announced in China over the last 18 months, and a recent white paper published by independent research institute EV Tank, forecast that China’s cumulative VRFB installed capacity will reach 24 GW by 2030. This is in line with China’s objective to reach a peak emission level in 2030 and being carbon neutral by 2060.

Supply chain development is not limited to China. The Dutch metallurgical company, AMG, announced a six million litre electrolyte plant in Germany and a partnership with Shell to build a vanadium processing facility in Saudi Arabia that will include an electrolyte plant. In Australia, the government has included vanadium mining and processing under its US$1,3 billion Modern Manufacturing Initiative, which will include construction of an electrolyte plant.

The USA and EU consider vanadium to be a critical material, and the recent Inflation Reduction Act is expected to further support the growth of the VRFB supply chain in the USA. In the EU, a preliminary agreement set in 2023 raised the renewable energy target from 32% to 42,5% by 2030.

Bushveld Minerals' Role

Bushveld Minerals has positioned itself to support vanadium’s role in the energy transition.

Its vertical integration strategy combines primary vanadium mining, beneficiation, and downstream energy storage businesses to drive adoption of VRFBs.

We remain bullish on energy storage demand in Africa and South Africa leading that growth – although recent reductions in local content requirements for public procurement and minimal policy support for vanadium-based value chains when compared to other countries may adversely impact the competitiveness of VRFBs.

Bushveld Energy’s development of the 3,5 MW solar PV, plus a 1 MW / 4 MWh VRFB hybrid mini-grid project for Vametco (the first of its kind in South Africa) demonstrates the case for VRFBs in energy storage. This project will serve as a VRFB reference site for the mining industry, utilities and other power users, and showcase the technological and commercial benefits of long-duration VRFB systems coupled with renewable energy.

The Department of Mineral Resources and Energy (DMRE) and Independent Power Producers (IPP) Office have noted stand-alone storage procurement of 513 MW in standalone, privately financed energy storage, over five sites. A further 1 231 MW has also been officially announced which is to follow the award of the first 513 MW.

Eskom’s battery procurement programme for 350 MW / 1 600 MWh is under way, with 199 MW / 833 MWh already awarded.

Many municipalities and private customers, especially mining companies, are increasingly considering storage to offset loadshedding, with regulation of self-supply of electricity having been reduced.