Historic Market Overview

As economies around the world began to recover from the devastating impact of the COVID-19 pandemic, industry pundits anticipated demand for vanadium to improve in 2021.

This expectation was fuelled by the fact that the vanadium market was, at the start of 2021, in a slight deficit of 317 mtV, with supply at 119 750 mtV.

Demand did indeed grow during the period under review, driven by a rebound in global steel production and consumption, excluding China, although demand was robust in the first part of the year.

Though still relatively small vanadium consumption in the energy storage sector also witnessed growth, as more projects were implemented.

Vanadium demand in 2021 was approximately 120 067 mtV with the steel production and vanadium redox flow battery (VRFB) markets accounting for 92% and 2% of the vanadium consumption, respectively.

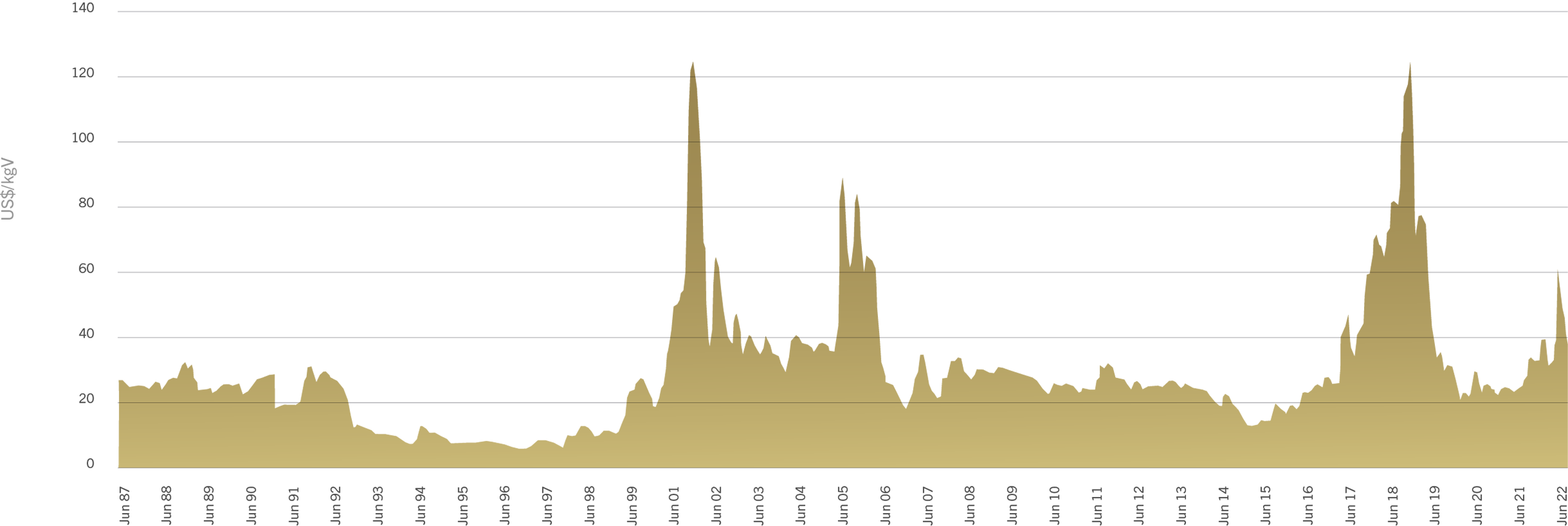

Prices traded in a fairly broad range, with the average price for the year being:

- US$34,31/kgV (2020: US$24,99/kgV) for the London Metal Bulletin in Europe

- US$34,86/kgV (2020: US$28,83/kgV) for Ryan’s Notes in North America

- US$33,52/kgV (2020: US$25,36/kgV) for the Asian Metals in China

In the final quarter of 2021, vanadium traded at an average price of US$32,33/kgV. While this is 38,1% higher than the previous year, it is marginally lower than long-term historical average vanadium prices.

Vanadium Price

The outbreak of war in Ukraine in February 2022 led to volatility in the vanadium market. This compounded an already tight market and resulted in vanadium prices spiking in March and into early April.

2021 saw challenges presented by global logistical delays which affect the supply chain which contributed to the irregular prices in North America relative to prices in Europe and China. In February 2022, supply disruptions generated by the Russia-Ukraine conflict resulted in increased buying of Chinese ferrovanadium. This trend continued through April and trade data shows that ferrovanadium exports rose to 934 t (gross) in April, up 176% year-on-year. The majority of these shipments have been destined for the Netherlands, Japan and South Korea.

Ferrovanadium prices rose rapidly through February and early March, driven by the combination of tight supply and market volatility. European ferrovanadium prices averaged at US$45,3/kgV in Q1 2022 and Chinese ferrovanadium prices averaged at US$46,4/kgV, which was an increase of 41% and 28% on the previous quarter, respectively. These factors hit the North American market most severely, where prices were anomalously high in March at US$73,50/ kgV, representing a premium of over 18% over regions.

China’s ongoing battle against COVID-19 and strict lockdowns has led to a weaker macroeconomic outlook, however, even with the reduction in the demand forecast as expected by Wood Mackenzie, a small deficit is expected this year.

In the VRFB space, there have been further announcements for developments not just in China but also in the North American and African markets. Wood Mackenzie maintains its previous forecast for annual VRFB installation capacity to rise to 1,5 GWh in 2024, which equates to 7,1 ktV consumption in 2024.

From 2024, Wood Mackenzie expects the market to enter a surplus as new greenfield projects come on-line and will outpace demand growth. It is worth noting that Wood Mackenzie assumes that all new projects announced will come into production, which may be an overly bullish assumption. This surplus is expected to peak in 2025-2026 and the market should gradually rebalance supported by growing demand due to higher intensity of use of vanadium in steel and as well as demand from vanadium redox flow batteries.

Overall, we retain our in-house view that supply remains concentrated and constrained with only limited new supply expected from primary greenfield projects, while co-production is still mainly driven by steel and iron ore fundamentals. As a result, primary producers of vanadium remain best positioned to meet the growing vanadium demand in the medium term.

Supply

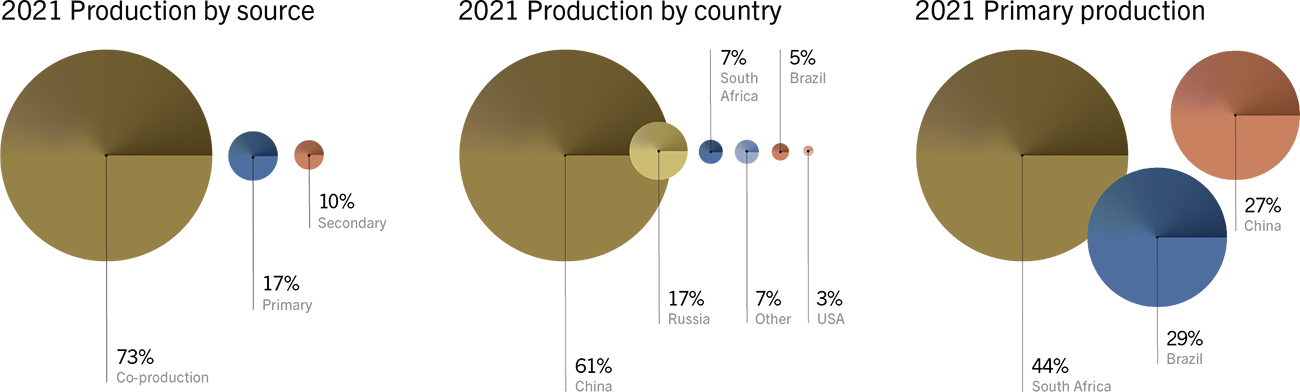

Co-production is the most significant source of vanadium supply, accounting for an estimated 73% of production in 2021.

Primary production was estimated at 17% of global supply in 2021. Secondary production accounted for approximately 10% of global supply in 2021.

In 2021, global vanadium supply increased to 119 750 mtV from 116 128 mtV in 2020. The world’s top vanadium producer, China, accounted for 61% of global vanadium supply in 2021.

Most of its vanadium was derived from co-production as most slag producers are Chinese steel mills. Russia is the second-largest producer and South Africa the third-largest, accounting for 17% and 7% of 2021 supply, respectively.

Supply Growth

Like most ferroalloys, vanadium has been and still is largely exposed to the market characteristics of steel and more specifically to the Chinese steel industry. Although Chinese steel production fell by 3% relative to 2020, due to the country’s COVID-19 mitigation measures, the world’s largest steel producer accounted for 53% of the world steel production at 1 033 Mt in 2021.

New vanadium supply may be triggered by the gradual implementation of International Maritime Organization’s (IMO) 2020 standard that introduces a new limit on sulphur emissions for ships operating outside designated emission control areas. The cutting of sulphur in bunker fuel would increase the volume of recycled spent oil catalysts. According to Wood Mackenzie, this increased vanadium supply could either displace projects with weaker economics or create a larger and more durable surplus. Nevertheless, secondary production is limited by both the availability of the necessary feedstock and the high costs of production.

Opportunities for growth in vanadium supply can be considered across three categories:

- Capacity expansions of current producers

- Re-commissioning of production plants that have been mothballed

- Greenfield project development

Capacity expansions have the highest probability of realisation, with the lowest capital requirements and fastest path to production. New greenfield projects face the most significant hurdles and the longest development timelines. Most of the recent greenfield projects announced for development are of a co-production or multi-commodity nature, suffer from relatively low grades and require significant capital and a relatively stable and higher price outlook than recent prices indicate.

Demand

Global vanadium consumption increased by approximately 7% to 120 067 mtV in 2021 from 112 157 mtV in 2020.

The steel industry accounted for 92% of total vanadium demand in 2021. It is expected to continue underwriting vanadium demand, led by China which accounts for about 60% of global vanadium consumption and whose growing intensity of use of vanadium in its steel sector thus maintaining positive vanadium demand momentum.

Notwithstanding regulation-driven growth in Chinese intensity of use of vanadium, China’s vanadium usage intensity, at 63 g/t of crude steel, still lags that of the developed economies in Europe, Japan and North America at 80 g/t. This suggests further support for demand even in a market expecting peak steel production later in 2022.

Consumption of the metal from the steel sector is forecast to rise by 2,8% in 2022 to 113 100 mtV. In the medium-term Wood Mackenzie forecasts that vanadium demand in the steel market will grow at a CAGR of about 3,1% through to 2030, when it is expected to reach approximately 136 000 tonnes by 2030.

The VRFB sector has the potential to create an additional large market for vanadium and transform the commodity into a prime energy metal. VRFB development could also support the development of new magnetite greenfield projects, producing high-purity vanadium pentoxide or trioxide for battery use.

In addition, as the requirement for energy storage for renewable energy sources increases, demand for vanadium from this sector is expected to increase over the coming years. While forecasts vary for energy storage market growth, they all agree on substantial if not exponential market growth, driven by the energy transition to greener energy.

Similarly, forecasts for the market penetration of vanadium redox flow batteries (VRFB’s) in this sector vary. Yet even the more conservative estimates see vanadium demand from the energy storage fundamentally shifting vanadium demand in the future. Still, the question is how quickly this demand actualises, in a stationary energy storage industry that, while seeing increasing momentum, is still nascent.

The growth in the number of large-scale vanadium redox flow batteries being commissioned or developed in recent years is encouraging in this respect. Examples include Sumitomo 51MWh VRFB installation in 2021, as a follow up to a 60MWh installation in 2015, and Rongke Power’s 800 MWh project in Dalian, China, to mention a few.

According to Guidehouse Insights, global annual deployments of VRFBs are expected to reach approximately 32,8 GWh in 2031. This presents significant growth with a CAGR of 41% across the forecast period.